Cultivate the expertise to drive sustainable change in real estate.

CAS Sustainable Real Estate

Do you have a passion for advancing sustainability where it truly counts? Unlock your potential to transform real estate investment for a sustainable future with our “CAS Sustainable Real Estate” at the University of Basel.

ESG in the real estate sector has become an important topic, as a high proportion of greenhouse gas emissions and energy consumption can be attributed to the building stock. Corresponding standards, their further development and strategies in the real estate industry are important beyond national borders.

The CAS is taught in English. The program focuses on the analysis, evaluation and transformation of real estate investments and real estate portfolios with regard to sustainability. It combines the latest academic research in the areas of sustainable real estate and real estate markets with comprehensive practical knowledge in the field of sustainable real estate management. And it offers students further education with both high practical relevance and an internationally recognized academic degree (Certificate of Advanced Studies). A Certificate of Advanced Studies (CAS) is an academic degree awarded upon completion of a continuing education program, i.e., post Master.

Digital Info Sessions

June 16, 2025 | 6.30pm

July 7, 2025 | 6.30pm

August 26, 2025 | 6.30pm

September 23, 2025 | 6.30pm

October 20, 2025 | 6.30pm

November 17, 2025 | 6.30pm

December 8, 2025 | 6.30pm

January 12, 2026 | 6.30pm

February 23, 2026 | 6.30pm

CAS Sustainable Real Estate | Overview

2026

Application deadline: February 2026

Start: 26.03.2026

-----------------------------------------------------------

Costs: CHF 9'500.-

Course Language: English

Program Director:Prof. Dr. Pascal Gantenbein

Host: Faculty of Business and Economics

Questions? Write us an E-Mail:

cas-sre@clutterunibas.ch

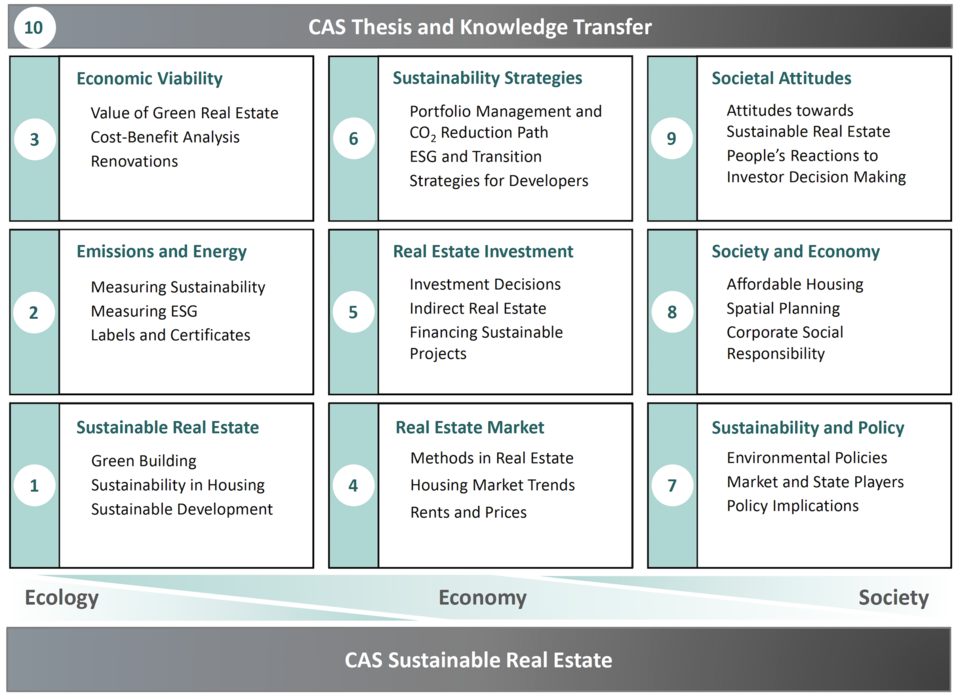

The core elements of the curriculum build upon the subject areas of real estate economics (real estate investments and real estate markets), ecological framework conditions (energy and climate policy), the social environment (real estate development and spatial planning) and the interfaces between these three areas. The program contains 10 consecutive modules and is completed with a CAS degree when all ECTS have been earned.

The program comprises 12 ECTS with a maximum study period of 6 months. Course dates are mostly on Friday/Saturday, the dates are published in the "Curriculum" section of this website.

Scope: 12 days of on-campus lecture + self-studying + CAS Thesis

Course language: English

Module I: Sustainable Real Estate | |

27.03.2025 (WWZ S13) | |

13:30 | Welcome and Course Overview |

| Why ESG? Dr. Jacqueline Henn |

| Real Estate Markets and the Relevance of Sustainability: Real Estate Investment Cycles, Green Building, and the Economics of Sustainable Development Prof. Dr. Pascal Gantenbein |

15:30 | Integrating Sustainability in Real Estate Strategies Alexandros Gratsias, J. Safra Sarasin |

17:00 | Welcome reception |

Module IIa: Emissions and Energy | |

28.03.2025 (WWZ S13) | |

09:00 | Sustainable Building |

| Measuring Greenhouse Gas (GHG) Emissions of Buildings: Energy Demand in Buildings, System Boundaries, Emission Factors, Calculation Models, Input Data Availability, Predicting the Impact of Retrofits Dr. Linus Walker, Wüest Partner |

12:30 | Lunch Break |

13:30 | Legal and Tax Aspects of Solar Infrastructure Benno Suter & Richard Wandfluh, Ernst & Young |

15:30 | Labels and Certificates: Proesses, requirements, benefits, impact E.g. Minergie, GEAK, SGNI/DGNB, SNBS, LEED Barbara Pataki, Durable |

17:00 | End of day |

Module IIb: Emissions and Energy | |

| 29.03.2025 (WWZ S13) |

09:00 | Strategies for Portfolio Managers: Operational Carbon Pathways and the Role of Measuring Embodied Carbon Nicolas Wild, Wüest Partner | ||

12:30 | Lunch Break | ||

13:30 | Measuring ESG: a multi country perspective ESG as a tool: What is and what can be measured, accuracy and data Marc Yeha, Ph.D., Manager Sustainability, Wüest Partner, Paris | ||

15:30 | Legal aspects of sustainable real estate Melanie von Rickenbach, Pestalozzi Attorneys at Law | ||

17:00 | End of day and module | ||

Module III: Sustainability and Economic Viability |

08.05.2025 (WP Auditorium) |

09:00 | The Economics of Energetic Renovations Investment costs, Market value: Impact by channel, Subsidies and tax savings Case studies Dr. Jörg Schläpfer, WüestPartner |

11:00 | Economic Value of Green Real Estate and current preferences Spotlight on Germany Rüdiger Hornung, WüestPartner, Munich |

12:30 | Lunch Break |

13:30 | Low-Tech Renovations: What is it, how to get there, functional coordination Stefan Barp, AFC |

15:30-17:00 | Module Assignment I-III (on-site) |

17:00 | End of Block 1 |

Module I | 27.03.2025 | Sustainable Real Estate | Prof. Dr. Pascal Gantenbein Dr. Jacqueline Henn Alexandros Gratsias (J. Safra Sarasin) |

Module IIa | 28.03.2025 | Emissions and Energy | Prof. Dr. Pascal Gantenbein / Dr. Jörg Schläpfer (Wüest Partner) Barbara Pataki (Durable) / Dr. Linus Walker (Wüest Partner) / Benno Suter & Richard Wandfluh (Ernst & Young) |

Module IIb | 29.03.2025 | Emissions and Energy | Prof. Dr. Pascal Gantenbein / Dr. Jörg Schläpfer (Wüest Partner) Marc Yehya & Nicolas Wild (Wüest Partner) / Melanie von Rickenbach (Pestalozzi Attorneys at Law) |

Module III | 08.05.2025 | Sustainability and Economic Viability | Dr. Jörg Schläpfer / Rüdiger Hornung (Wüest Partner) Dr. Stefan Barp (AFC AG) |

Module IV | 09.05.2025 | Real Estate Market | Prof. Dr. Pascal Gantenbein / Prof. Dr. Christian Kleiber / Dr. Beat Spirig Fredy Hasenmeile (Raiffeisen) |

Module V | 10.05.2025 | Real Estate Investment | Dr. Constantin Kempf Prof. Dr. Pascal Gantenbein / Team Wüest Partner |

Module VI | 05.06.2025 | Sustainability Strategies | Prof. Dr. Pascal Gantenbein Michael Böniger & Daniela Jorio (UBS) / Rafik Awad (ZKB) / Dr. Agnes Neher (Baloise) |

Module VIIa | 06.06.2025 | The Role of Policy in Establishing Sustainability | Prof. Dr. Aya Kachi Prof. Dr. John Wargo (Yale University) |

Module VIIb | 07.06.2025 | The Role of Policy in Establishing Sustainability | Prof. Dr. Aya Kachi Dr. Miriam Lüdi (Resilientsy) |

Module VIII | 20.06.2025 | The Society and the Economy | Dr. Jörg Schläpfer (Wüest Partner) Dr. Dorothea Baur (Baur Consulting) Regula Küng (Basel Stadt) |

Module IX | 21.06.2025 | Societal Attitudes toward Sustainable Real Estate & Introduction to Thesis | Prof. Dr. Aya Kachi Dr. Beat Spirig |

Module X | 19.09.2025 20.09.2025 | CAS Thesis and Knowledge Transfer | Prof. Dr. Pascal Gantenbein / Dr. Jörg Schläpfer (Wüest Partner) |

Curriculum and speakers may be subject to changes

Highly qualified lecturers from academia as well as from the industry stand for the quality of the program. The Certificate of Advanced Studies (CAS) in Sustainable Real Estate is offered by the Faculty of Business Administration and Economics of the University of Basel in cooperation with Wüest Partner AG (WP), one of the leading real estate service providers in Switzerland. The Faculty of Business Administration and Economics at the University of Basel is the sponsor of the Certificate of Advanced Studies (CAS) in Sustainable Real Estate. The program is run by Professor Pascal Gantenbein. As a practice partner, Wüest Partner AG is involved in the development and implementation of some of the teaching modules. In addition, participants are granted free access to data, publications and applications for the duration of the course.

The "CAS in Sustainable Real Estate" course is aimed at an ambitious and international clientele who wants to build up and hone their skills in the field of sustainable real estate investment and development. Participants have either gained experience in the real estate sector, e.g., in real estate investment, construction, finance or administration, or they would like to develop their skills in this area. They are looking for a part-time continuing education program that combines a high academic level with professional practice. Students have 3 to 5 years of successful professional experience and an academic degree.

The following requirements must be met for admission to the program:

- a completed degree (Bachelor's or Master's) from a university recognized by the University of Basel

- 3 to 5 years of successful professional experience in the real estate sector

- Written and spoken English (recommended level B2/C1)

In justified exceptional cases, candidates who can provide evidence of an adequate professional background and corresponding professional qualifications may be admitted to the program. (In all other respects, the provisions of § 2 of the regulations for continuing education studies apply.)

Location

The modules will take place at the Faculty of Business and Economics, Peter Merian-Weg 6, 4002 Basel and at Wüest Partner AG, Bleicherweg 5, 8001 Zurich.

Fees and payment

The total tuition fee for the "CAS Sustainable Real Estate" program is CHF 9,500. The tuition fee includes fees for examinations, teaching and learning materials, but does not include costs for special services such as travel or accommodation. Once admission to the course has been confirmed, the entire tuition fee is due. The tuition fee can be paid in three partial payments.

Attendance: Participation in the courses of the degree program is compulsory; in the event of more than 20% absence of the total time required, a corresponding substitute course must be completed in consultation with the program management.

The payment is due as follows:

- CHF 2,500 4 weeks after confirmed admission to the degree program

- CHF 4,000 1 month before the start of the degree program

- CHF 3,000 3 months after the start of the degree program

In the event of withdrawal from the contract 20 days before the start of the course, 30% of the tuition fee remains due. In the event of withdrawal in the first 30 days after the start of the course, 70% of the tuition fee remains due. In the event of a later withdrawal, the entire tuition fee is due.

Cancellation or course insurance is recommended; this is the responsibility of the student. (For tuition fees, see § 10 of the regulations for the continuing education program. In all other respects, the provisions of § 10 of the Regulations for Continuing Education Studies apply.)

The program committee reserves the right to make changes to the content.

Conditions of Participations

Registrations will be considered on a first-come, first-served basis. The number of participants is limited. After receipt of the registration, the registration confirmation will be sent by post. If participation is not possible, the participant will be contacted by phone or e-mail. Cancellations up to eight weeks before the start of the course are possible without incurring any costs. In addition, the terms and conditions of the University of Basel apply.

Prof. Dr. Pascal Gantenbein

Faculty of Business and Economics / WWZ

Financial Management

Professor | Dean of Studies

WWZ / Faculty of Business and Economics

Financial Management

Peter Merian-Weg 6

4002 Basel

Schweiz

Claudia Moret

CAS Sustainable Real Estate

WWZ / Faculty of Business and Economics

Peter Merian-Weg 6

4002 Basel

Schweiz

Tel.: +41 61 207 69 69

Mail: cas-sre@clutterunibas.ch