12754 Corporate Mergers & Acquisitions

This course presents the theories and empirical evidence on corporate control transactions, the process of evaluating acquisition targets and its application in practice. Findings on the reaction of stock prices to information on control transactions are used to analyze the effects of various policy options in such transactions. Strategies of acquisition are studied as well as defensive measures against them, their purpose and their consequences. The class combines lecture material, quantitative and qualitative analyses and discussions of relevant news. There is an emphasis on fundamental concepts of valuation and other areas of corporate finance related to Mergers & Acquisitions.

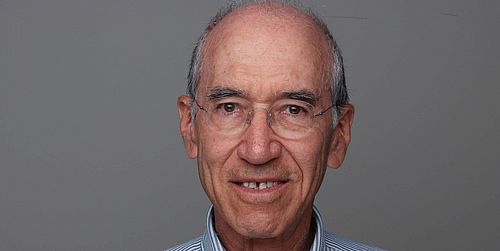

Lecturer

Prof. Yakov Amihud

Professor of Entrepreneurial Finance

Stern School of Business, New York University

Dates

Duration: 5 until 15 August 2019

Place: Faculty of Business and Economics, Peter Merian-Weg 6

Monday, 5 August 2019, 9.45-12.15

Tuesday, 6 August 2019, 9.45-12.15

Wednesday, 7 August 2019, 9.45-12.15

Thursday, 8 August 2019, 9.45-12.15

Monday, 12 August 2019, 9.45-12.15

Tuesday, 13 August 2019, 9.45-12.15

Wednesday, 14 August 2019, 9.45-12.15

Thursday, 15 August 2019, 9.45-12.15

Assessment Details

- Homework: 35%

- Final exam: 65 %

Date of final exam: 19 August 2019, 14:15

Recommended Prerequisites

Solid understanding of business and economics on the BA level

Corporate Finance (10138)

Intermediate Finance (42778)

Macroeconomics and Finance (40105)

Course Information

- Course directory

- Syllabus

- Reading Material: see syllabus

For further information please contact the <link de studium summer-school internal link in current>Summer School office.

Quick Links

Social Media